How will rising interest rates affect drivers in Singapore?

21 Jun 2023|6,482 views

As the global economy recovers from the COVID-19 pandemic, interest rates are expected to rise in many countries, including Singapore. While this may not immediately impact buying a used car, it can affect the financing options available to new and used car buyers.

How interest rates in the U.S.A impact Singapore

Singapore's interest rates are closely linked to global interest rates. As the U.S.A Federal Reserve hikes interest rates in response to inflation, interest rates in Singapore are likely to follow suit. This means that borrowing costs will increase, and those financing their homes with floating-rate bank loans may feel the pinch.

Moreover, rising interest rates can lead to tighter credit conditions, making it more difficult for car buyers to secure loans or qualify for favourable terms.

Singapore core inflation hits an all-time high

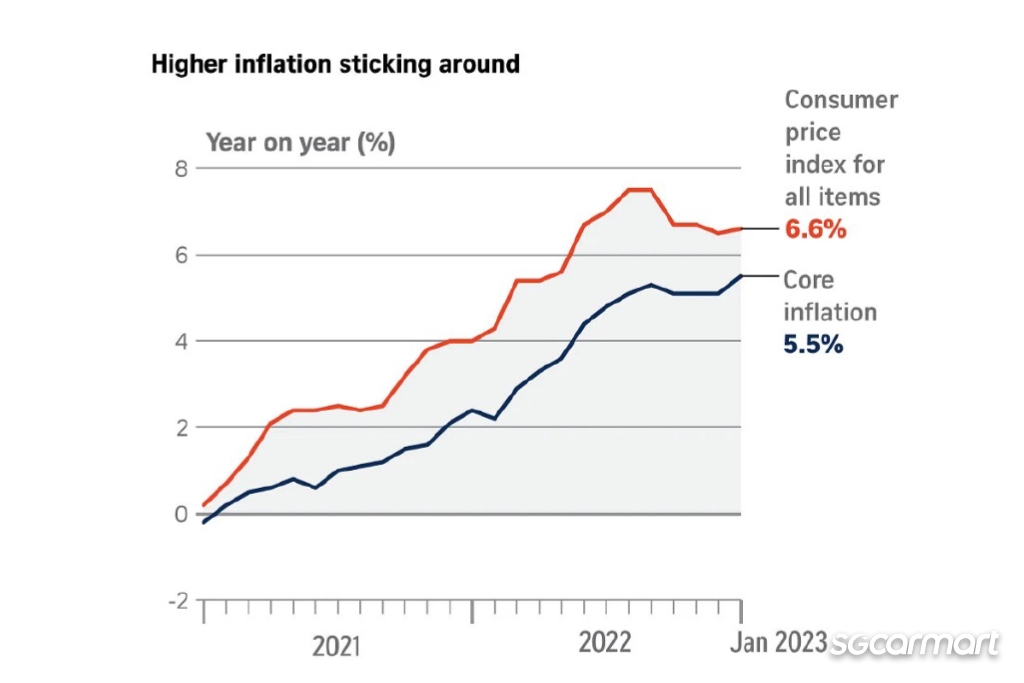

In a recent article published on The Straits Times, it was reported that core inflation rose to 5.5% year on year in January 2023, the highest rate since November 2008, according to the Monetary Authority of Singapore.

It is possible that the 5.5% core inflation rate could lead to higher prices for used cars in Singapore. However, other factors such as market competition, the condition of the used car, and the negotiation skills of the buyer could also play a significant role in determining the final price. It can also lead to slightly higher borrowing costs, as lenders may adjust their interest rates to account for the decline in the value of money.

Car ownership costs in Singapore on the rise

The high costs of owning a car in Singapore cannot be attributed to a single factor alone.

Several types of car ownership costs are expected to rise in the current high inflation environment, such as higher taxes, fees, labour and import costs; notably the COE and GST, making them less accessible to many Singaporeans.

Record high COE Premiums

With CAT A, CAT B and CAT E hitting record highs earlier in May, it could be a huge deterrent for potential car buyers. CAT A premiums shot past the $100k mark for the first time since the introduction of the COE system. The upward trend is unlikely to see a dip anytime soon, given the expectation of a lower quota for the third quarter of 2023.

High Interest Rates on Car Loans

The interest rates on car loans in Singapore can be relatively high due to factors such as high-risk premiums, processing fees, and the generally higher cost of borrowing in Singapore compared to some other countries, adding to the overall cost of purchasing a car.

What are the different types of car loans in Singapore?

There are several car loans for individuals to finance their car purchases.

Hire Purchase Loans are the most common type of car loan in Singapore. The borrower makes a down payment on the car and then repays the loan amount plus interest in instalments over a predetermined period.

Balloon Scheme Loans are when the borrower makes lower monthly payments during the loan period, with a large lump sum payment due at the end of the loan term. This option may suit those with a high income but prefer lower monthly payments.

Lease-to-Own schemes are quite popular for private hire purposes, where the driver rents the car for a predetermined period with an option to buy the car at the end of the lease term. This option may be suitable for those who want to test the car before committing to a purchase or those who may not have enough cash for a down payment but can afford monthly payments.

How to save big on car loans in Singapore

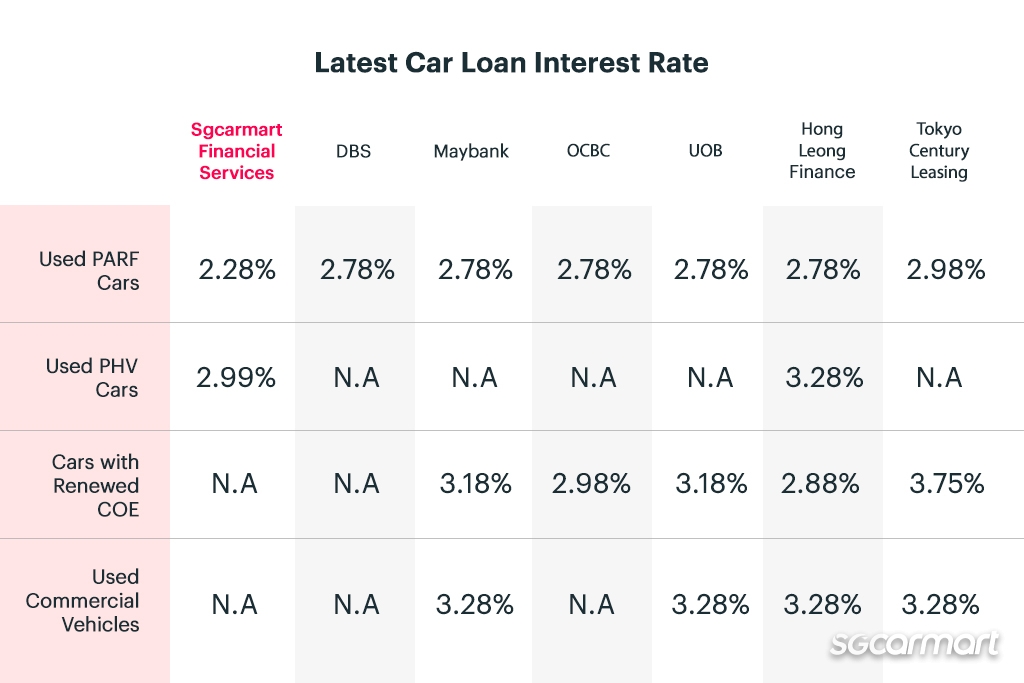

Let's look at the different interest rates across various financial institutions in SingaporeThe general rule of thumb would be that when interest rates are lower, you pay less in interest over the life of the loan, which means that taking up a car loan to purchase a car will be less expensive eventually.

Do note that while most, if not all financial institutions, offer an interest rate of 2.78% (accurate as of 24th April 2023), your monthly repayment also depends on your initial downpayment and loan tenure.

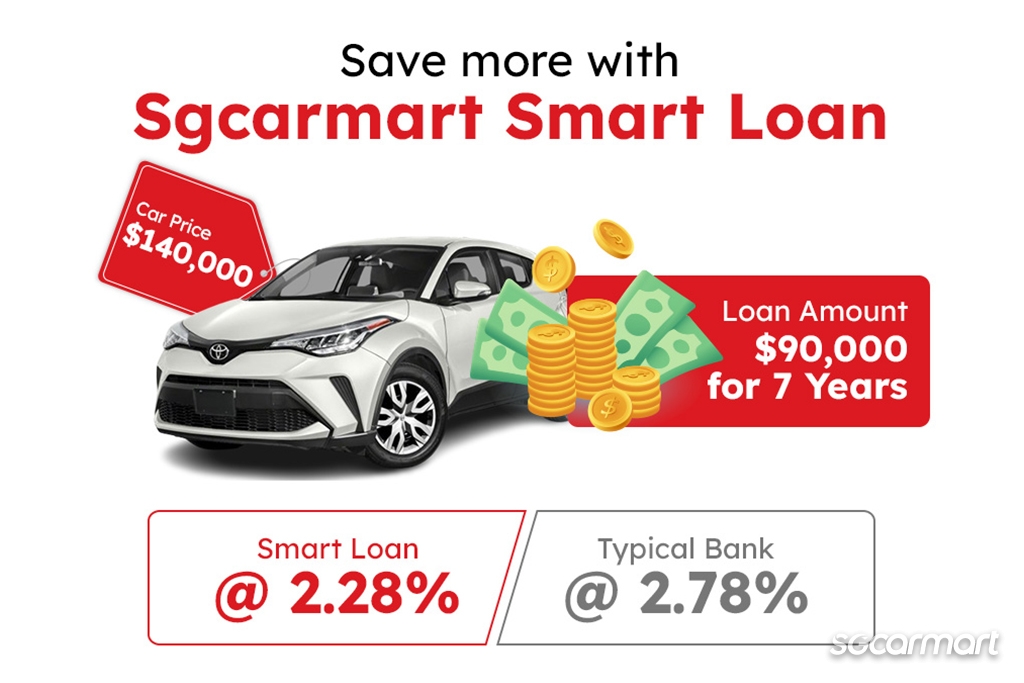

At this rate, a typical car loan of $90,000 for 7 years could incur over $17,000 on interest paid. To help consumers save more, Sgcarmart Smart Loan is offering a below-market-rate of 2.28%, significantly lower than the current market average, and can help used car buyers save thousands of dollars!

Sgcarmart Smart Loan

Sgcarmart has introduced a fully digital car financing service called Sgcarmart Smart Loan to boost used car sales in Singapore. This new financing initiative is designed for those who want a flexible, affordable, and hassle-free financing option for their used car purchase.

Using a Toyota C-HR as an example, as seen in the simple infographic on the right, you can save around 17% off your interest with the Smart Loan!

Used car buyers can also compare their savings for different cars using the online loan calculator with other financial institutions' rates.

Here are some related articles that might interest you

Buying a used car can be a risky business. But what if we could take away the risk?

Mythbusted: Is high mileage always a con when it comes to buying used cars?

Does a high COE price mean a higher car resale value? Let's find out!

As the global economy recovers from the COVID-19 pandemic, interest rates are expected to rise in many countries, including Singapore. While this may not immediately impact buying a used car, it can affect the financing options available to new and used car buyers.

How interest rates in the U.S.A impact Singapore

Singapore's interest rates are closely linked to global interest rates. As the U.S.A Federal Reserve hikes interest rates in response to inflation, interest rates in Singapore are likely to follow suit. This means that borrowing costs will increase, and those financing their homes with floating-rate bank loans may feel the pinch.

Moreover, rising interest rates can lead to tighter credit conditions, making it more difficult for car buyers to secure loans or qualify for favourable terms.

Singapore core inflation hits an all-time high

In a recent article published on The Straits Times, it was reported that core inflation rose to 5.5% year on year in January 2023, the highest rate since November 2008, according to the Monetary Authority of Singapore.

It is possible that the 5.5% core inflation rate could lead to higher prices for used cars in Singapore. However, other factors such as market competition, the condition of the used car, and the negotiation skills of the buyer could also play a significant role in determining the final price. It can also lead to slightly higher borrowing costs, as lenders may adjust their interest rates to account for the decline in the value of money.

Car ownership costs in Singapore on the rise

The high costs of owning a car in Singapore cannot be attributed to a single factor alone.

Several types of car ownership costs are expected to rise in the current high inflation environment, such as higher taxes, fees, labour and import costs; notably the COE and GST, making them less accessible to many Singaporeans.

Record high COE Premiums

With CAT A, CAT B and CAT E hitting record highs earlier in May, it could be a huge deterrent for potential car buyers. CAT A premiums shot past the $100k mark for the first time since the introduction of the COE system. The upward trend is unlikely to see a dip anytime soon, given the expectation of a lower quota for the third quarter of 2023.

High Interest Rates on Car Loans

The interest rates on car loans in Singapore can be relatively high due to factors such as high-risk premiums, processing fees, and the generally higher cost of borrowing in Singapore compared to some other countries, adding to the overall cost of purchasing a car.

What are the different types of car loans in Singapore?

There are several car loans for individuals to finance their car purchases.

Hire Purchase Loans are the most common type of car loan in Singapore. The borrower makes a down payment on the car and then repays the loan amount plus interest in instalments over a predetermined period.

Balloon Scheme Loans are when the borrower makes lower monthly payments during the loan period, with a large lump sum payment due at the end of the loan term. This option may suit those with a high income but prefer lower monthly payments.

Lease-to-Own schemes are quite popular for private hire purposes, where the driver rents the car for a predetermined period with an option to buy the car at the end of the lease term. This option may be suitable for those who want to test the car before committing to a purchase or those who may not have enough cash for a down payment but can afford monthly payments.

How to save big on car loans in Singapore

Let's look at the different interest rates across various financial institutions in SingaporeThe general rule of thumb would be that when interest rates are lower, you pay less in interest over the life of the loan, which means that taking up a car loan to purchase a car will be less expensive eventually.

Do note that while most, if not all financial institutions, offer an interest rate of 2.78% (accurate as of 24th April 2023), your monthly repayment also depends on your initial downpayment and loan tenure.

At this rate, a typical car loan of $90,000 for 7 years could incur over $17,000 on interest paid. To help consumers save more, Sgcarmart Smart Loan is offering a below-market-rate of 2.28%, significantly lower than the current market average, and can help used car buyers save thousands of dollars!

Sgcarmart Smart Loan

Sgcarmart has introduced a fully digital car financing service called Sgcarmart Smart Loan to boost used car sales in Singapore. This new financing initiative is designed for those who want a flexible, affordable, and hassle-free financing option for their used car purchase.

Using a Toyota C-HR as an example, as seen in the simple infographic on the right, you can save around 17% off your interest with the Smart Loan!

Used car buyers can also compare their savings for different cars using the online loan calculator with other financial institutions' rates.

Here are some related articles that might interest you

Buying a used car can be a risky business. But what if we could take away the risk?

Mythbusted: Is high mileage always a con when it comes to buying used cars?

Does a high COE price mean a higher car resale value? Let's find out!