COE Analysis July '24: Is $90-100k the new normal?

03 Jul 2024|23,440 views

COE price trend over the past quarter: April to June 2024 vs January to March 2024

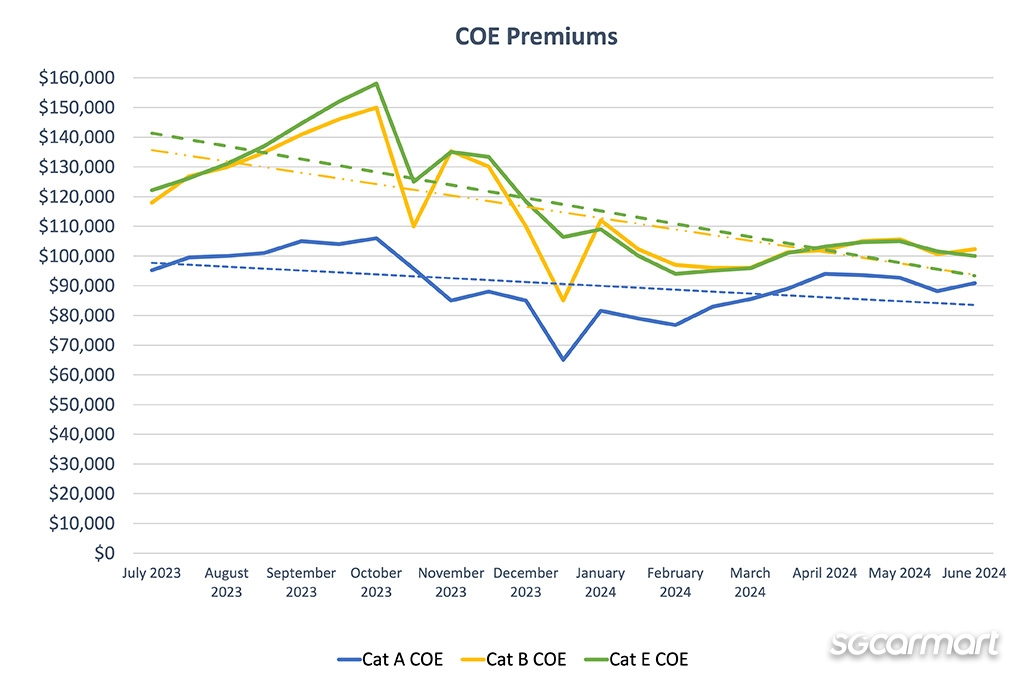

We don't want to say that we celebrated too soon - because it's true that even up till June, COE premiums haven't been put through the worst of spikes seen over the past 12 months.

It is, nonetheless, where they are stabilising right now that might be a point of concern, since the current picture doesn't look as rosy as it did back during our previous analysis in April. Specifically, premiums have been pulled back above the $100,000 line in both Category B and E.

It thus also tracks that when averaged out over April to June this year, COE premiums rose across all categories when compared to the previous quarter spanning January to March. Even though Cats B and E are the ones that will catch your eye right now, the rise in premiums for both isn't too pronounced; Cat B only rose by 4.9%, while Cat E rose by 2.5%.

It is Cat A, however, that is likely to raise some eyebrows: With a whopping 16.5% increase.

Before delving into notable events in Singapore's car market over the past quarter, it should be noted first that premiums have risen uniformly despite the fact that the COE supply has continued to rise as promised. Consequently, the simple and logical deduction here is that demand is continuing to outpace supply.

If anything, it's a good reminder that the cut-and-fill approach that is now in place to bolster COE supply is resolutely not a silver bullet that will magically bring premiums back down.

As for what has continued to sustain pressure on demand, the past quarter (as we mentioned previously) saw The Car Expo taking place over the weekend of mid-April. A post-event report by SPH Media, which organises the event, noted that nearly 900 cars were sold to the tune of more than $160 million in sales - which represented a 33% and 29% increase respectively from the October 2023 iteration.

Just as important, however, are the sorts of car models that we’ve seen impact the local car market in Singapore since the start of the year - a growing crew of models eligible for a Category A COE. We'll broadly separate these into three main categories: The post-Motor Show crop, the newly-launched names, as well as... the reintroduced crew.

January's Singapore Motor Show already saw the launch of a fair number of models: Lexus brought out its first-ever Cat A-model, the LBX Hybrid; among other cars, Hyundai pulled the covers off its luminous, facelifted Avante Hybrid; and BMW, of course, presented two cars you probably see a lot on our roads today - the iX1 and X2. (All of these cars were present at April's The Car Expo.)

The 2024 Singapore Motor Show introduced a number of heavy-hitting Cat A crowd favourites, including the likes of the Hyundai Avante Hybrid and the BMW X2 sDrive16i. Both cars also made an appearance at April's The Car Expo

But within the April to June period itself, Cat A has only grown more crowded still.

Volkswagen Singapore surprised many when it pulled the covers off the third-generation Tiguan with a 129bhp engine. China's GAC Aion also made fresh landfall here over the past quarter, with both its Y Plus crossover and ES sedan slotting neatly into Cat A. Tesla Singapore even introduced a 110kW variant of the Model 3, back in mid-May.

But of course, as BYD has been eager to note, Singapore's best-selling model for 2024 thus far across the board (in other words, whether we're talking EVs or ICE cars) is a car that is likely excelling on the strength of its Cat A variant: The Atto 3. The electric SUV was initially launched in 2022 with a 150kW motor, but was then quickly reintroduced with a less-powerful 100kW variant in March 2023. Interestingly, on BYD's latest pricelist, dated 24 June 2024, the 150kW Atto 3 is no longer listed.

The big question now, of course, is whether the pressure on Cat A will hold.

While we're not soothsayers, what we can definitively state is that the room is filling up even more. Returning to BYD yet again, a Cat A-friendly variant of the Seal, named the Seal Dynamic 100kW, was launched towards the end of June alongside a massive sales marathon across the entire brand.

Barring any regulatory changes by the LTA, we don't expect the trend of power-cutting to go away any time soon.

Vehicle de-registrations - still on the rise

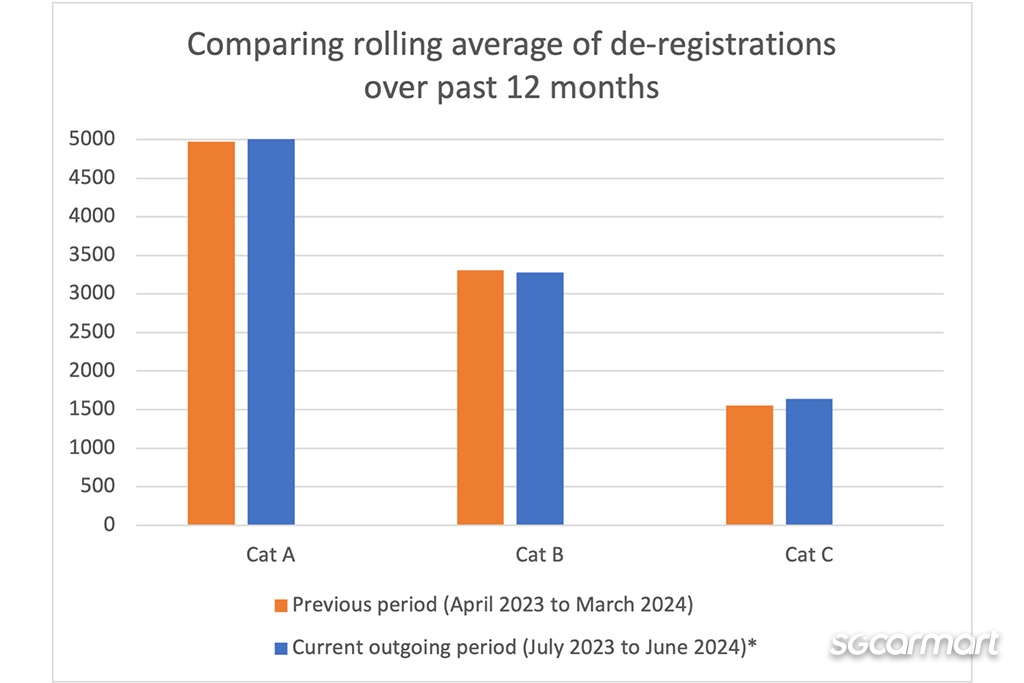

To reiterate once more, because the new cut-and-fill approach makes it impossible to predict COE supply, our analyses now focus more on the trend of vehicle de-registrations - which contribute to the certificates returned to the supply pool.

The current calculation method by the LTA takes the moving average of de-registrations over the past 12-month period, and then divides it by four (in accordance with a quarter's worth of supply) to determine the baseline number of COEs for the upcoming quarter. Thereafter, this supply is purportedly bolstered by impending de-registrations in the coming years as per the cut-and-fill approach.

By extrapolating data from July 2023 to May 2024 out across 12 months, our data indicates that the overall rolling average of de-registrations for the July 2023 to June 2024 period will be 5% higher than that in the previous 12-month period (April 2023 to March 2024). This is exactly the same level of increase that we previously saw.

Whereas the increase in de-registrations was previously led by the passenger car categories, things are a bit mixed this time round. The figure for Cat A is projected to rise by 8% from 4,975, while Cat B de-registrations appear likely to fall very slightly - by 1%, from 3,310 previously.

Where de-registrations in Cat C (for commercial vehicles) previously dipped, however, they are now projected to pick up, with a 6% increase.

Portions of de-registrations from all three categories ultimately contribute to the supply pool in the open Cat E.

The increasing de-registrations continue to remain in line with the LTA's previous statements that COE quota is set to rise over the next couple of years.

*Data extrapolated from 11-month period, spanning July 2023 to May 2024

New car pricing: April to June 2024

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

As COE premiums have crept back upwards, it should come as no surprise that new car prices have also climbed back up again - although, again, these are nowhere near the heights experienced last October. Based on our sample, there was a 4.4% increase in new car prices over the past quarter between April to June, when compared to the tri-monthly average between Jan to March this year. For reference, we noted that new car prices had slid by 3% on average in our previous analysis.

The rise in new car prices doesn't strike as particularly noteworthy, and feels quite proportionate to the movement of COE premiums. Nonetheless, it does mean that most of our entry-level compact cars - such as the Nissan Note e-POWER and BYD Dolphin - have found their way back into the $150,000-ish region again (at the time of writing this).

Most popular used cars: March to May 2024

Over the three-month period between March to May 2024, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $14,982 |

| Honda Civic 1.6A VTi | 2017 | $15,866 |

| Nissan Qashqai 1.2A DIG-T | 2016 | $13,713 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $21,307 |

| Toyota Corolla Altis 1.6A Elegance | 2015 | $16,790 |

We previously wondered if the cooling off of used car prices would hold steady as COE premiums also reached a new point of equilibrium.

Thankfully, that does seem to be the case now.

Across over 400 listings spanning the three-month period, the average annual depreciation figure for our perennial marker of the market, the 2016-registered Honda Vezel, fell to $14,982. This marks the first time in more than a year that figure has slid back below $15,000 - since our March 2023 analysis.

Also making a splash on our listings over the period were 2017 registered units of the Honda Civic, 2016 registered units of the Nissan Qashqai, and 2015 registered units of the Toyota Corolla Altis.

Still, to return to the Vezel, it must be noted that the latest depreciation figures do not indicate a massive dip (to put things plainly, $14,982 is just $18 below $15,000 after all).

In line with the way COE premiums have held steady, so too have the average depreciation figures across all three months for the Vezel also showed minimal variance. In other words, the data appears to be indicating that the used car market continues to be moving quite closely in step with the new car one.

What is noteworthy, however, is the surge in volume of listings for the Top 5: A rise of more than 300 listings, representing a 38% increase. Another noteworthy figure: This increase was spearheaded by the Vezel, for which listings jumped by more than 100 from quarter to quarter.

How the increased volume has arisen is unclear, but a few possibilities present themselves: Customers either trading in their older cars for new ones, selling their cars for profit amidst high COE premiums, or simply switching to other modes of transport (including car-sharing).

Here's a rewind of our previous three COE analyses!

COE Analysis Apr '24: Every category is finally below $100k

COE Analysis Jan '24: We don't know how to forecast anymore

Oct '23: COE quota forecast to remain level come November

COE price trend over the past quarter: April to June 2024 vs January to March 2024

We don't want to say that we celebrated too soon - because it's true that even up till June, COE premiums haven't been put through the worst of spikes seen over the past 12 months.

It is, nonetheless, where they are stabilising right now that might be a point of concern, since the current picture doesn't look as rosy as it did back during our previous analysis in April. Specifically, premiums have been pulled back above the $100,000 line in both Category B and E.

It thus also tracks that when averaged out over April to June this year, COE premiums rose across all categories when compared to the previous quarter spanning January to March. Even though Cats B and E are the ones that will catch your eye right now, the rise in premiums for both isn't too pronounced; Cat B only rose by 4.9%, while Cat E rose by 2.5%.

It is Cat A, however, that is likely to raise some eyebrows: With a whopping 16.5% increase.

Before delving into notable events in Singapore's car market over the past quarter, it should be noted first that premiums have risen uniformly despite the fact that the COE supply has continued to rise as promised. Consequently, the simple and logical deduction here is that demand is continuing to outpace supply.

If anything, it's a good reminder that the cut-and-fill approach that is now in place to bolster COE supply is resolutely not a silver bullet that will magically bring premiums back down.

As for what has continued to sustain pressure on demand, the past quarter (as we mentioned previously) saw The Car Expo taking place over the weekend of mid-April. A post-event report by SPH Media, which organises the event, noted that nearly 900 cars were sold to the tune of more than $160 million in sales - which represented a 33% and 29% increase respectively from the October 2023 iteration.

Just as important, however, are the sorts of car models that we’ve seen impact the local car market in Singapore since the start of the year - a growing crew of models eligible for a Category A COE. We'll broadly separate these into three main categories: The post-Motor Show crop, the newly-launched names, as well as... the reintroduced crew.

January's Singapore Motor Show already saw the launch of a fair number of models: Lexus brought out its first-ever Cat A-model, the LBX Hybrid; among other cars, Hyundai pulled the covers off its luminous, facelifted Avante Hybrid; and BMW, of course, presented two cars you probably see a lot on our roads today - the iX1 and X2. (All of these cars were present at April's The Car Expo.)

The 2024 Singapore Motor Show introduced a number of heavy-hitting Cat A crowd favourites, including the likes of the Hyundai Avante Hybrid and the BMW X2 sDrive16i. Both cars also made an appearance at April's The Car Expo

But within the April to June period itself, Cat A has only grown more crowded still.

Volkswagen Singapore surprised many when it pulled the covers off the third-generation Tiguan with a 129bhp engine. China's GAC Aion also made fresh landfall here over the past quarter, with both its Y Plus crossover and ES sedan slotting neatly into Cat A. Tesla Singapore even introduced a 110kW variant of the Model 3, back in mid-May.

But of course, as BYD has been eager to note, Singapore's best-selling model for 2024 thus far across the board (in other words, whether we're talking EVs or ICE cars) is a car that is likely excelling on the strength of its Cat A variant: The Atto 3. The electric SUV was initially launched in 2022 with a 150kW motor, but was then quickly reintroduced with a less-powerful 100kW variant in March 2023. Interestingly, on BYD's latest pricelist, dated 24 June 2024, the 150kW Atto 3 is no longer listed.

The big question now, of course, is whether the pressure on Cat A will hold.

While we're not soothsayers, what we can definitively state is that the room is filling up even more. Returning to BYD yet again, a Cat A-friendly variant of the Seal, named the Seal Dynamic 100kW, was launched towards the end of June alongside a massive sales marathon across the entire brand.

Barring any regulatory changes by the LTA, we don't expect the trend of power-cutting to go away any time soon.

Vehicle de-registrations - still on the rise

To reiterate once more, because the new cut-and-fill approach makes it impossible to predict COE supply, our analyses now focus more on the trend of vehicle de-registrations - which contribute to the certificates returned to the supply pool.

The current calculation method by the LTA takes the moving average of de-registrations over the past 12-month period, and then divides it by four (in accordance with a quarter's worth of supply) to determine the baseline number of COEs for the upcoming quarter. Thereafter, this supply is purportedly bolstered by impending de-registrations in the coming years as per the cut-and-fill approach.

By extrapolating data from July 2023 to May 2024 out across 12 months, our data indicates that the overall rolling average of de-registrations for the July 2023 to June 2024 period will be 5% higher than that in the previous 12-month period (April 2023 to March 2024). This is exactly the same level of increase that we previously saw.

Whereas the increase in de-registrations was previously led by the passenger car categories, things are a bit mixed this time round. The figure for Cat A is projected to rise by 8% from 4,975, while Cat B de-registrations appear likely to fall very slightly - by 1%, from 3,310 previously.

Where de-registrations in Cat C (for commercial vehicles) previously dipped, however, they are now projected to pick up, with a 6% increase.

Portions of de-registrations from all three categories ultimately contribute to the supply pool in the open Cat E.

The increasing de-registrations continue to remain in line with the LTA's previous statements that COE quota is set to rise over the next couple of years.

*Data extrapolated from 11-month period, spanning July 2023 to May 2024

New car pricing: April to June 2024

Sgcarmart does its best to use a pool of popular models from authorised dealers to analyse the general price trends of new cars.

As COE premiums have crept back upwards, it should come as no surprise that new car prices have also climbed back up again - although, again, these are nowhere near the heights experienced last October. Based on our sample, there was a 4.4% increase in new car prices over the past quarter between April to June, when compared to the tri-monthly average between Jan to March this year. For reference, we noted that new car prices had slid by 3% on average in our previous analysis.

The rise in new car prices doesn't strike as particularly noteworthy, and feels quite proportionate to the movement of COE premiums. Nonetheless, it does mean that most of our entry-level compact cars - such as the Nissan Note e-POWER and BYD Dolphin - have found their way back into the $150,000-ish region again (at the time of writing this).

Most popular used cars: March to May 2024

Over the three-month period between March to May 2024, these were the five most listed used cars on Sgcarmart.

| Model | Year of registration | Average depreciation (approx.) |

| Honda Vezel 1.5A X | 2016 | $14,982 |

| Honda Civic 1.6A VTi | 2017 | $15,866 |

| Nissan Qashqai 1.2A DIG-T | 2016 | $13,713 |

| Mercedes-Benz C-Class C180 Avantgarde | 2016 | $21,307 |

| Toyota Corolla Altis 1.6A Elegance | 2015 | $16,790 |

We previously wondered if the cooling off of used car prices would hold steady as COE premiums also reached a new point of equilibrium.

Thankfully, that does seem to be the case now.

Across over 400 listings spanning the three-month period, the average annual depreciation figure for our perennial marker of the market, the 2016-registered Honda Vezel, fell to $14,982. This marks the first time in more than a year that figure has slid back below $15,000 - since our March 2023 analysis.

Also making a splash on our listings over the period were 2017 registered units of the Honda Civic, 2016 registered units of the Nissan Qashqai, and 2015 registered units of the Toyota Corolla Altis.

Still, to return to the Vezel, it must be noted that the latest depreciation figures do not indicate a massive dip (to put things plainly, $14,982 is just $18 below $15,000 after all).

In line with the way COE premiums have held steady, so too have the average depreciation figures across all three months for the Vezel also showed minimal variance. In other words, the data appears to be indicating that the used car market continues to be moving quite closely in step with the new car one.

What is noteworthy, however, is the surge in volume of listings for the Top 5: A rise of more than 300 listings, representing a 38% increase. Another noteworthy figure: This increase was spearheaded by the Vezel, for which listings jumped by more than 100 from quarter to quarter.

How the increased volume has arisen is unclear, but a few possibilities present themselves: Customers either trading in their older cars for new ones, selling their cars for profit amidst high COE premiums, or simply switching to other modes of transport (including car-sharing).

Here's a rewind of our previous three COE analyses!

COE Analysis Apr '24: Every category is finally below $100k

COE Analysis Jan '24: We don't know how to forecast anymore

Oct '23: COE quota forecast to remain level come November

Thank You For Your Subscription.